NOTE: Many people believe the president should be elected by the national popular vote, instead of by the Electoral College vote. For an interesting discussion of popular vote vs. Electoral College, see the many comments at the bottom of the post.

To rage against the U.S. Electoral College is worse than a distraction. It is useless, it’s a waste of time.

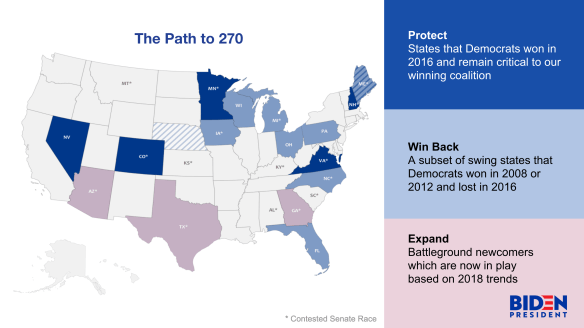

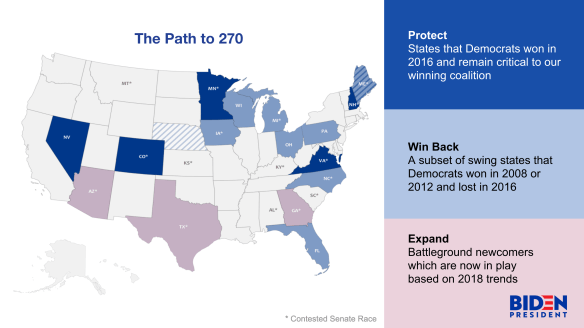

If you want to know the names of the president and vice president who will be sworn in next January, 2021, if you care who the next president will be, you have to WIN A MAJORITY of the Electoral College in the November 2020 presidential election. It’s as simple as that. And as difficult. Just look at the Electoral College map above.

Raging against the Electoral College is worse than a distraction because you can’t get rid of it, and you can’t change it.

Where does the Electoral College come from?

It comes from the U.S. Constitution, Article II, Section 1.

“Each State shall appoint, in such a Manner as the Legislature thereof may direct, a Number of Electors, equal to the whole Number of Senators and Representatives to which the State may be entitled in the Congress . . . The Electors shall meet in their respective States and vote by Ballot for two Persons . . . And they shall make a List of all the Persons voted for, and of the Number of Votes for each; which List they shall sign and certify, and transmit sealed . . . to the President of the Senate. . . . The Person having the greatest Number of Votes shall be the president, if such Number be a Majority of the whole Number of Electors appointed . . .

. . . after the Choice of the President, the Person having the greatest Number of Votes of the Electors shall be the Vice President.”

Straightforward, right?

Each state gets a number of electors equal to its two U.S. Senators plus the number of members the state has in the U.S. House of Representatives. The candidate with the most electoral votes is the next president.

But only if that number is a majority of all the electoral votes. That’s important. Note that the Constitution requires a MAJORITY of the Electoral College. Not a minority.

The above system has been used in every presidential election since the first one in 1788, when a majority chose George Washington without a whole lot of dispute.

The Electoral College is arithmetic, specifically addition! No subtraction, multiplication, long division, geometry or calculus.

So why the consternation about the Electoral College?

Good question. It starts with the fact that the electoral votes of smaller states are proportionately greater than the votes of larger states. That’s because large states and small states all have two U.S. senators as the base point for their number of electors. I will leave it to others with a better understanding of mathematics to consider how significant that proportional difference is in the context of 538 total electoral votes.

A winner-take-all system of awarding the electoral votes makes the proportional difference worse. Much, much worse.

The presidential candidate who wins a state’s popular vote wins ALL that state’s electoral votes. The losing candidate gets NONE of the state’s electoral votes. Even though he or she may have won 45 percent of the state’s popular vote. (The only exceptions are Maine and Nebraska.)

As a result of the winner-take-all system, on top of the proportional advantage of the smaller states, the electoral vote for president does not perfectly reflect the popular vote nationwide. But usually — almost always — one candidate wins both the Electoral College majority and a national popular vote majority or plurality and becomes president.

(NOTE: A candidate must win a MAJORITY in the Electoral College. That’s mandated in the Constitution. Failing an Electoral College majority, the election goes to the House of Representatives. In 1800, Thomas Jefferson and Aaron Burr tied with 73 votes each. And the House of Representatives deadlocked 35 times before finally electing Jefferson to be second president of the U.S.

A benefit of the winner-take-all allocation of electoral votes is that it makes failure of one candidate to win an Electoral College majority nearly impossible. Therefore, the winner-take-all system protects against the prospect of an election being decided in the House of Representatives.)

In the national popular vote, the winner might NOT have a majority. When there are three or more candidates, minor candidates slice off little pieces of the popular vote, potentially leaving the winner with less than a majority. When a winner has the most votes but it’s less than a majority, he wins with only a MINORITY. That’s called a PLURALITY.

Bottom line: It is possible for one candidate to win the Electoral College and another candidate to win the national popular vote! Usually it’s not a problem. It’s only happened a few times in the whole history of the U.S.

But it happened in 2016!

Donald Trump won a clear majority (304 to 227) in the Electoral College. Hillary Clinton won a plurality of the national popular vote (48.2% to 46.1%) (65,853,514 to 62,984,828 approximately).

Even though not a majority, Clinton had more popular votes than Trump. And Trump had more electoral votes. Many people think Clinton should therefore be president. But sorry, the winner was Trump, the one with the Electoral College majority. It says so in the Constitution, and the Constitution is the law of the land.

A majority, of course, is 50% plus 1. If you’re a mathematician or a perfectionist, you might calculate: 50% – 48.2% = 1.8%.

And you might ask, where are those 1.8% of the popular votes which denied Clinton a majority. I’m not a mathematician, but I doubt that even a mathematician can answer that question for sure.

It might be reasonable to suggest: Maybe that 1.8% of the popular vote is reflected in the Electoral College total?

Trump is a minority president, and Clinton would also be a minority president. Is it possible to speculate that the Electoral College might reflect the will of the whole nation as accurately as the popular vote?

My head spins! Are these mathematical questions, or metaphysical questions?

And that, my friends, is why many people wonder about the Electoral College and the national popular vote.

In the next post, Part 2, we’ll discuss how the winner-take-all system came to be.

And more important, why it’s a waste of time worrying about the Electoral College, because we’re not going to change it. At least not before the November election. Which is only five months away.

Rather than raging against the Electoral College, your time would be better spent trying to WIN the Electoral College majority for the candidate of your choice. That is the point of this series of posts.

See you in Part 2.

— John Hayden

Share this post with friends and family.